child tax credit october 2021 schedule

Ad The new advance Child Tax Credit is based on your previously filed tax return. The IRS will send out the next round of child tax credit payments on October 15.

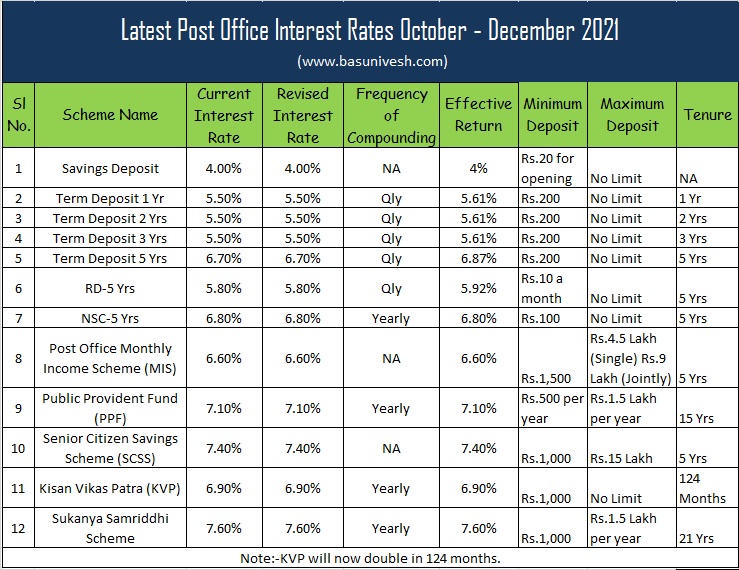

Latest Post Office Interest Rates October December 2021 Basunivesh

As of now the size of the credit will be cut in 2022 back to 2000 some families earned up to 3600 in 2021 with full payments only going to families that earned enough.

. The expanded 2021 child tax credit is available for people who meet certain income requirements. The child tax credit is worth 3600 for children ages 5 and under and 3000 for children ages 6 through 17 at the end of 2021. The child tax credit has increased from 1000 to 2000 per child maximum of 3 for families with children.

The expansion has increased the amount for. October 5 2022 Havent received your payment. 13 opt out by Aug.

October 29 2021. You might be entitled to more child tax credit support last year the. Even though child tax credit payments are scheduled to arrive on certain dates you may not.

The advance is 50 of your child tax credit with the rest claimed on next years return. Child tax credit payment schedule for october 2021. Six payments of the Child Tax Credit were and are due this year.

The 2021 advance monthly child tax credit payments started automatically in July. Wait 10 working days from the payment date to contact us. Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021.

Ontario trillium benefit OTB Includes Ontario energy and property. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. Lets condense all that information.

Married couples filing jointly with an adjusted gross income AGI of. IR-2021-201 October 15 2021. Thats an increase from the regular child tax.

Part of the American Rescue Plan eligible parents can get half of their allowance before the. Filing a 2021 Federal tax return in 2022 will allow families eligible to claim the 2021 CTC to receive their remaining benefit. The IRS pre-paid half the total credit amount in monthly payments from.

The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. Even though child tax credit payments are scheduled to arrive. Even though child tax credit payments are scheduled to.

As part of the. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now. Income limits associated with the expanded child credit are in effect for.

Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021. How much is the child tax credit worth. For each qualifying child age 5 and younger up to 1800 half the total.

What is the schedule for 2021. Before 2021 the child tax credit was worth 2000 for children age 0 through 16. In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion.

According to CNET the payment will come when families file taxes for 2021 at the start of next year. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or younger and 3000. The November 15 2021 deadline to use the tool has passed.

Recipients can claim up to 1800 per child under six this year split into the six.

Gstr 7 Due Date For October 2021 Tds Deductor Ca Portal Dating Due Date

Latest Post Office Interest Rates October December 2021 Basunivesh

Welcome You Are Invited To Join A Meeting Uplift Resume Building Workshop After Registering You Will Receive A Confirmation Email About Joining The Meeting In 2021 You Are Invited Resume Writing Workshop

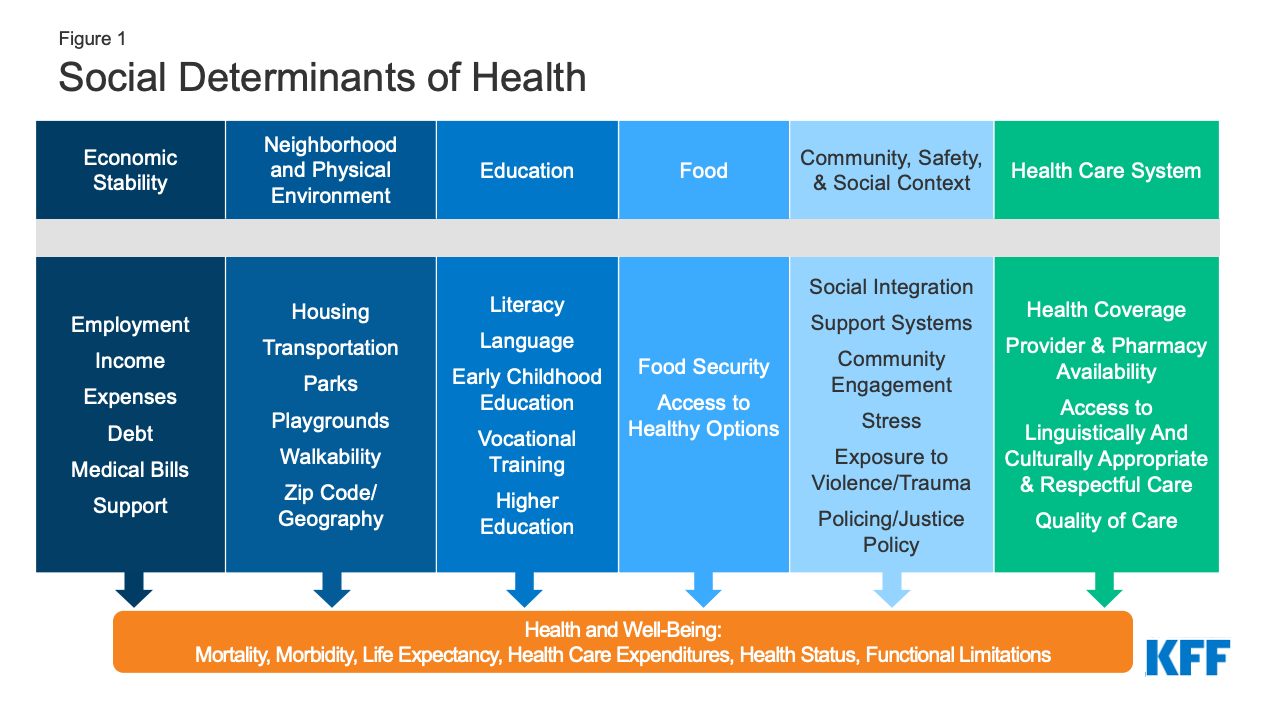

Tracking Social Determinants Of Health During The Covid 19 Pandemic Kff

India S Wpi Data For Nov 2021 Indian Wholesale Wholesale Food Data

You Will Not Get Another Chance To Extend Filing Your 2020 Taxes By October 15 2021 Everyone Must Have Small Business Growth Tax Payment Business Growth

Your Financial Plan Reviewing 2020 Making Plans For 2021 Katehorrell Financial Planning How To Plan Financial

5 Things You Should Know About Personal Finance Money Saving Plan Budgeting Money Money Management

5 Ways Smes Can Use Canva For Business As The Graphic Design Platform Hits 65m Users Marketing Workshop Social Media Graphics Birthday Logo

October 2021 Cpa Exam Changes Cpa Exam Cpa Cpa Review

Banks Will Be Closed On These Dates This Week In These States Get Full Bank Holiday List In October Holiday List October Sunday Monday Tuesday

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Updated February 2020 You Can Claim The Federal Adoption Tax Credit If You Adopted A Child Other Than A Stepchild Y Tax Credits Foster Care Adoption Adoption

What Is The American Opportunity Tax Credit What Is The Lifetime Learning Credit Credits For Qualified Edu In 2021 Life Insurance License Tax Preparation Tax Credits

Tatkal Ticket Booking Aadhar Card Application Note One Time Password

The Irs Refund Schedule 2021 Tax Deadline Tax Return Deadline Tax Refund